Wyoming Credit: Secure and Reliable Financial Services

Wyoming Credit: Secure and Reliable Financial Services

Blog Article

Why You Need To Pick Cooperative Credit Union for Financial Stability

Lending institution stand as pillars of financial stability for many people and areas, using a special technique to banking that prioritizes their members' well-being. Their dedication to reduce charges, competitive prices, and individualized customer care establishes them in addition to standard banks. There's even more to debt unions than simply financial rewards; they likewise foster a feeling of community and empowerment amongst their members. By picking cooperative credit union, you not just secure your economic future but additionally end up being component of a helpful network that values your economic success.

Lower Costs and Affordable Rates

Lending institution typically supply lower charges and affordable prices compared to conventional financial institutions, giving consumers with a much more solvent option for managing their financial resources. Among the key benefits of credit scores unions is their not-for-profit structure, allowing them to focus on member benefits over maximizing earnings. This distinction in emphasis allows credit report unions to offer reduced charges for services such as inspecting accounts, interest-bearing accounts, and car loans. Furthermore, credit report unions generally give more competitive rate of interest on cost savings accounts and fundings, equating to far better returns for participants and reduced loaning expenses.

Personalized Client Service

Supplying customized assistance and individualized remedies, cooperative credit union prioritize customized customer service to satisfy participants' details monetary demands effectively. Unlike traditional banks, cooperative credit union are understood for cultivating a much more individual relationship with their members. This tailored method includes understanding each member's distinct financial circumstance, goals, and choices. Lending institution team typically put in the time to pay attention diligently to members' problems and provide tailored recommendations based on their specific requirements.

One key facet of individualized customer support at cooperative credit union is the concentrate on monetary education and learning. Credit history union representatives are devoted to helping participants comprehend numerous financial items and solutions, empowering them to make informed decisions (Wyoming Credit). Whether a participant is looking to open a cost savings account, look for a lending, or plan for retirement, credit score unions provide personalized support every step of the way

Furthermore, cooperative credit union typically go above and beyond to guarantee that their participants really feel valued and sustained. By constructing solid relationships and cultivating a sense of community, lending institution develop a welcoming atmosphere where participants can trust that their monetary health remains in excellent hands.

Solid Neighborhood Emphasis

With a commitment to sustaining and cultivating neighborhood connections community efforts, credit scores unions prioritize a strong community focus in their operations - Credit Union Cheyenne WY. Unlike typical financial institutions, credit score unions are member-owned monetary establishments that run for the benefit of their participants and the areas they offer. This special framework enables credit rating unions to concentrate on the well-being of their members and the local area instead than only on generating profits for exterior investors

Cooperative credit union usually engage in various community outreach programs, sponsor neighborhood occasions, and collaborate with other organizations to deal with area requirements. By spending in the community, credit scores unions assist stimulate local economic climates, produce work opportunities, and boost overall high quality of life for homeowners. Additionally, debt unions are known for their involvement in financial literacy programs, providing academic sources and workshops to aid area participants make educated economic choices.

Financial Education and Help

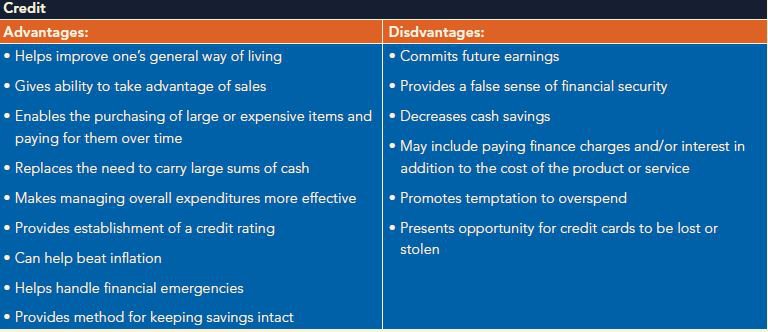

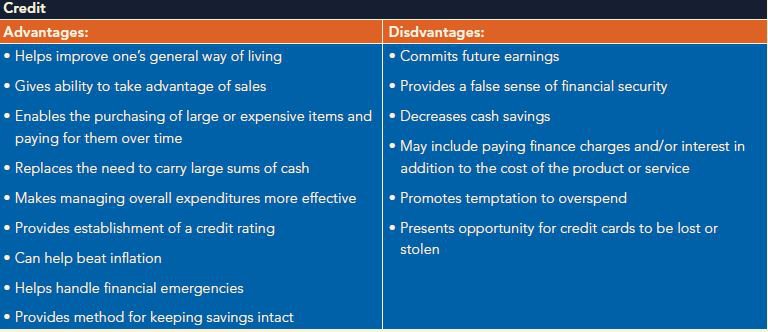

In promoting monetary literacy and using my website assistance to individuals in demand, cooperative credit union play a crucial function in encouraging neighborhoods in the direction of economic stability. Among the key benefits of cooperative credit union is their focus on giving financial education to their participants. By offering workshops, seminars, and one-on-one therapy, credit rating unions assist people much better understand budgeting, saving, investing, and taking care of financial debt. This education furnishes members with the understanding and abilities required to make enlightened financial decisions, eventually bring about boosted financial well-being.

Additionally, credit report unions commonly supply aid to participants encountering monetary problems. Whether it's with low-interest fundings, versatile payment plans, or financial therapy, lending institution are devoted to aiding their members conquer challenges and achieve monetary stability. This personalized approach collections cooperative credit union besides standard banks, as they focus on the monetary health of their participants most of all else.

Member-Driven Decision Making

Members of cooperative credit union have the chance to voice their opinions, provide feedback, and also compete settings on the board of directors. This level of engagement fosters a sense of possession and neighborhood among the members, as they have a straight effect on the direction and policies of the lending institution. By actively entailing participants in decision-making, cooperative credit union can much better tailor their solutions to fulfill the special needs of their community.

Inevitably, member-driven choice making not only boosts the general member experience yet likewise promotes openness, count on, and accountability within the credit union. It showcases the participating nature of cooperative credit union and their commitment to offering the best passions of their members.

Verdict

To conclude, credit history unions offer an engaging choice for monetary security. With lower charges, affordable rates, individualized customer care, a strong neighborhood emphasis, and a commitment to monetary education and learning and support, lending institution focus on participant benefits and empowerment. With member-driven decision-making procedures, cooperative credit union advertise openness and accountability, making sure a stable monetary future for you can try this out their participants.

Credit unions stand as pillars of monetary stability for numerous individuals and neighborhoods, supplying an unique technique to financial that prioritizes their participants' well-being. Unlike conventional banks, credit unions are member-owned financial organizations that run for the advantage of their participants and the areas they offer. Additionally, credit scores unions are understood for their participation in monetary proficiency programs, supplying instructional resources and workshops to aid area participants make educated financial choices.

Whether it's through low-interest finances, adaptable settlement strategies, or economic therapy, credit unions are committed to helping their participants get over obstacles and attain economic security. With reduced charges, competitive rates, personalized consumer solution, a solid neighborhood focus, and a commitment to economic education and learning and help, credit you could check here score unions prioritize participant advantages and empowerment.

Report this page